ETH Price Prediction: Analyzing the Path to $5,000

#ETH

- Technical Momentum: ETH trading above key moving averages with approaching upper Bollinger Band resistance

- Fundamental Support: Industry collaborations and technological enhancements strengthening Ethereum's ecosystem

- Market Sentiment: Strong retail and institutional demand despite some concerning signals from related assets

ETH Price Prediction

Technical Analysis: ETH Approaches Key Resistance Level

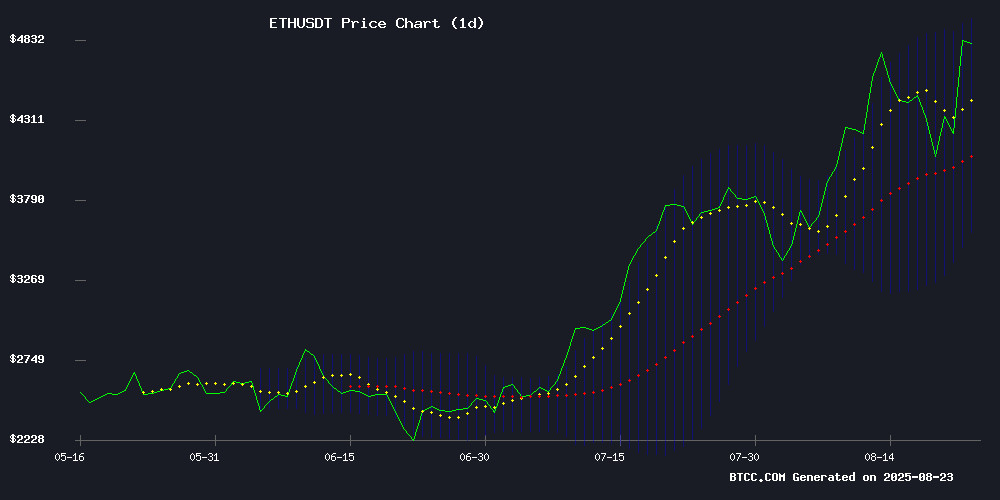

ETH is currently trading at $4,733.37, showing strong momentum above its 20-day moving average of $4,270.32. The MACD indicator remains negative at -7.7760 but shows signs of convergence as the gap between MACD and signal line narrows. Price action is testing the upper Bollinger Band at $4,956.90, suggesting potential resistance NEAR the $5,000 psychological level. According to BTCC financial analyst Olivia, 'The technical setup indicates ETH is in a bullish phase, though traders should watch for potential rejection at the $4,950-$5,000 resistance zone.'

Market Sentiment: Positive Developments Support ETH Momentum

Recent industry developments are creating favorable conditions for Ethereum's price appreciation. The collaboration between Optimism and Flashbots to enhance OP Stack sequencing, along with Kraken's integration of distributed validator technology, demonstrates growing institutional confidence in Ethereum's infrastructure. BTCC financial analyst Olivia notes, 'These technical upgrades combined with strong market demand signals, as seen in the MoonBull whitelist frenzy, provide fundamental support for ETH's push toward $5,000. However, investors should monitor ETHZilla's performance concerns as a counter-indicator.'

Factors Influencing ETH's Price

Optimism and Flashbots Collaborate to Enhance OP Stack Sequencing

Optimism has partnered with Flashbots to integrate advanced sequencing tools into the OP Stack, targeting improved scalability and transaction fairness across Ethereum Layer 2 networks. The collaboration introduces Flashblocks, a solution delivering 200ms confirmation times on the Superchain, already operational on Base and Unichain.

The upgrade addresses critical pain points—spam reduction, MEV revenue capture, and customizable latency—for developers building on OP Stack-powered chains like OP Mainnet. With over 60% of Ethereum L2 activity running on OP Stack, this move reinforces Optimism's dominance in the rollup ecosystem.

Flashbots' proven Ethereum infrastructure brings battle-tested sequencing features to the Superchain, enabling builders to tailor transaction speeds while maintaining decentralization. The partnership signals a strategic push to optimize Layer 2 performance as adoption surges.

Kraken Pioneers Distributed Validator Technology for Ethereum Staking

Kraken has set a new industry standard by becoming the first major exchange to fully integrate SSV Network's Distributed Validator Technology (DVT) into its Ethereum staking infrastructure. The August 22, 2025 deployment marks a watershed moment for validator resilience, slashing risk mitigation, and decentralized fault tolerance.

The breakthrough implementation distributes validator key shares across independent operators, eliminating single points of failure. Geographic diversity and collaborative validation mechanics now underpin Kraken's staking operations—a structural upgrade that could redefine institutional participation in Ethereum's proof-of-stake ecosystem.

SSV Network's protocol ensures automated recovery mechanisms and continuous uptime, addressing historic pain points around validator penalties. This technological leap coincides with growing institutional demand for bulletproof staking solutions as Ethereum solidifies its position as the backbone of decentralized finance.

MoonBull ($MOBU) Whitelist Frenzy Signals Strong Market Demand as Early Access Spots Dwindle

MoonBull ($MOBU), an Ethereum-backed meme coin targeting aggressive traders, has ignited a whitelist rush with nearly all early access spots claimed. The project's limited rollout has created a supply shock, driving urgency among retail traders, influencers, and crypto funds.

Whitelist participants secure exclusive benefits: guaranteed lowest token price, unreleased staking rewards, bonus allocations, and confidential updates ahead of the public presale. This demand surge suggests institutional interest beyond typical meme coin hype.

The project's momentum reflects growing appetite for high-risk, high-reward crypto plays in 2025's volatile market. MoonBull's strategic whitelist approach mirrors successful token launches that leveraged artificial scarcity to fuel secondary market demand.

Ethereum Nears $5,000 Milestone Amid Surging Trading Volume

Ethereum (ETH) is on the verge of breaking the $5,000 barrier after a dramatic price surge to $4,830, fueled by a 14.2% gain in the last 24 hours and a 93% spike in trading volume, now nearing $70 billion. The rally, which accelerated on Friday, has captivated the cryptocurrency community as anticipation builds for a potential all-time high.

Market sentiment has been bolstered by dovish remarks from U.S. Federal Reserve Chair Jerome Powell, injecting confidence across financial markets, including digital assets. Institutional interest is also playing a pivotal role, with whales and corporate investors accumulating ETH even as major ETFs like BlackRock and Grayscale offload shares. Buyers have absorbed $148 million worth of Ethereum, sustaining upward momentum.

ETHZilla Shares Plummet Nearly 30% Amid Dilution Concerns Despite $349M Ether Holdings

ETHZilla (ETHZ), the rebranded crypto treasury firm formerly known as 180 Life Sciences, saw its shares crash nearly 30% on Friday after shareholders filed to offer up to 74.8 million convertible shares. The move sparked fears of dilution, which erodes existing shareholders' stakes as new shares flood the market. Outstanding shares will surge 46% to 239.3 million if the offering is fully converted.

The sell-off overshadowed ETHZilla's recent pivot to crypto, which had initially sent shares soaring. The company disclosed holdings of 82,186 ETH (worth $349 million) and $238 million in cash equivalents, acquired at an average price of $3,806 per token. Peter Thiel's Founders Fund backs the venture, holding a 7.5% stake alongside investments in other Ethereum-focused entities.

Market sentiment turned sharply despite the heavyweight endorsement. The stock had rallied 80% year-to-date before Friday's plunge, reflecting the volatility of crypto-linked equities. ETHZilla won't receive proceeds from the share conversions, leaving investors to weigh dilution risks against its substantial Ether treasury.

Kraken Integrates SSV Network's DVT to Enhance Ethereum Staking

Kraken has made a significant leap in Ethereum staking by fully adopting Distributed Validator Technology (DVT) through its integration with SSV Network. This move marks the first time a major exchange has deployed DVT across all its Ethereum validators, setting a new standard for security, reliability, and scalability in institutional-grade staking services.

Jonathan Marcus, Kraken's Head of Strategy, Custody and Staking, emphasized the transformative impact of SSV's DVT stack on validator performance. The technology distributes validator key fragments across multiple operators, reducing single points of failure and aligning with Ethereum's decentralization ethos. SSV Network's proven track record in Ethereum staking solutions adds credibility to this infrastructure upgrade.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH has a strong possibility of testing the $5,000 level in the near term. The price is currently trading just 5.6% below this milestone at $4,733.37, with bullish technical positioning above key moving averages.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,733.37 | Bullish |

| 20-Day MA | $4,270.32 | Support |

| Upper Bollinger | $4,956.90 | Resistance |

| Distance to $5,000 | 5.6% | Achievable |

BTCC financial analyst Olivia suggests that while technical momentum is positive, the $4,950-$5,000 range represents a critical resistance zone that may require several attempts to breach successfully.